prefer a call?

If you’d prefer to talk to an expert from our financial team, click the button below to request a call back at your preferred time or email us on contactme@gidltd.com.

Why do I need to be covered?

- Protect Your Budget: Coverage helps you avoid unexpected, high-cost repairs or payouts, so you don’t have to dip into savings or take on debt.

Peace of Mind: Knowing you’re protected against breakdowns or accidents means you can drive with confidence, free from worry about unexpected expenses.

Stay on the Road: Insurance helps get you back on the road quickly after a breakdown or accident without delays due to repair or replacement costs.

Avoid Depreciation Losses: GAP insurance covers the difference between the value of your car and what you owe, so you’re not stuck paying off a vehicle that’s no longer usable.

Frequently Asked Questions

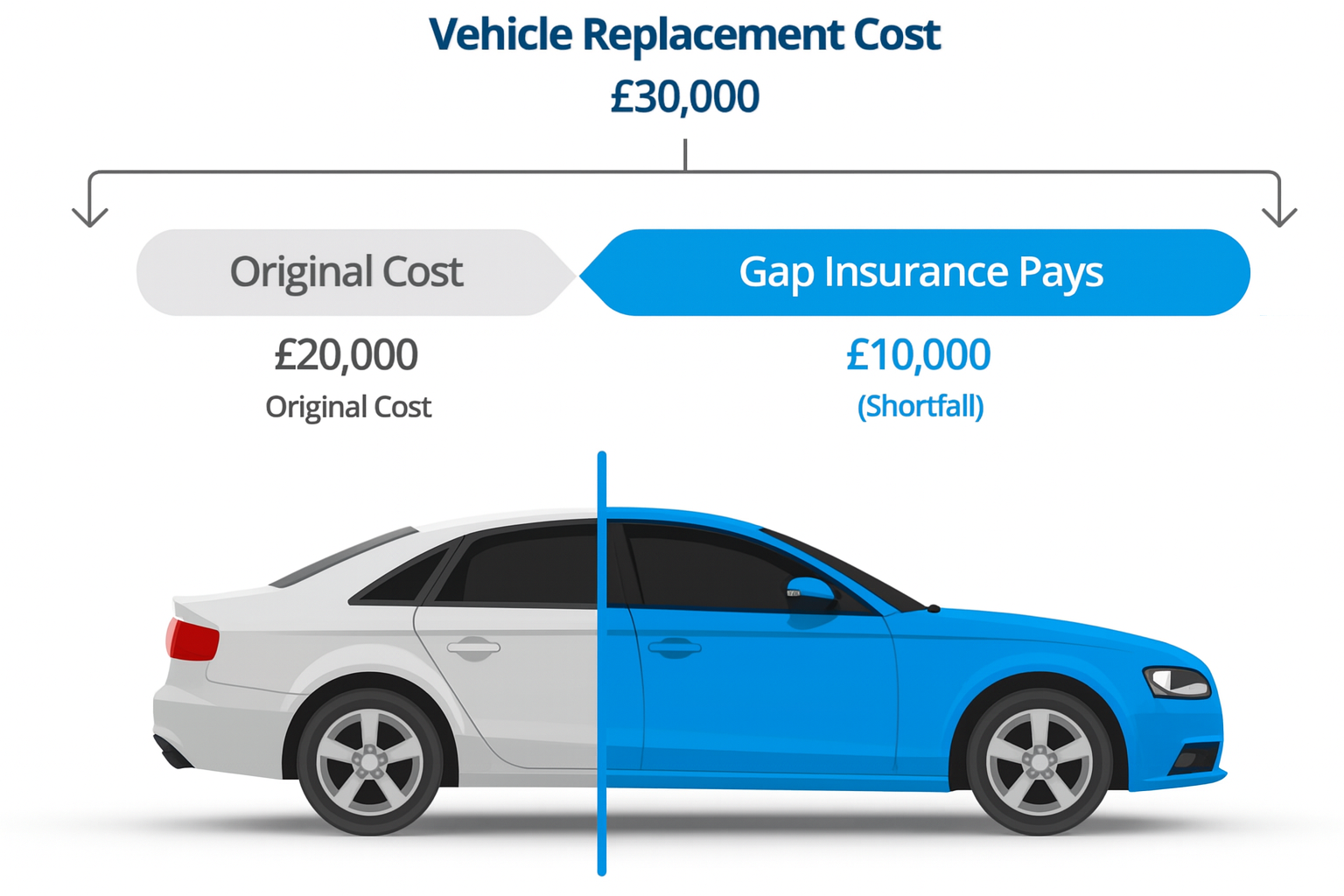

GAP stands for Guaranteed Asset Protection. If your vehicle is declared a total loss (due to accident, fire, theft, flood, etc.), your motor insurer will often only pay its market value at the time — which may be significantly less than what you originally paid (or still owe).

Our GAP product covers the “gap” — i.e. the shortfall between the insurer’s payout and your original purchase price or outstanding finance, whichever is the greatest.

- Your motor insurance is designed to pay the market value of the vehicle at the time of loss, not what you paid or owe.

- Without GAP, you could be left with a significant financial burden.

- Our product gives you peace of mind — you won’t be left out of pocket in the event of a write-off.

- You’re not committing to a long-term fixed policy from the start.

- You pay a set monthly fee when you activate your policy.

- This gives flexibility: you can choose to benefit from Gap for up to 48 month or remove GAP when it suits your usage/ownership.